In my view the SaaS squeeze forces us to prioritize hybrid models over pure vendor dependency#CloudStrategy #EnterpriseIT

Quick Video Breakdown: This Blog Article

This video clearly explains this blog article.

Even if you don’t have time to read the text, you can quickly grasp the key points through this video. Please check it out!

If you find this video helpful, please follow the YouTube channel “AIMindUpdate,” which delivers daily AI news.

https://www.youtube.com/@AIMindUpdate

Read this article in your native language (10+ supported) 👉

[Read in your language]

Navigating the Great SaaS Squeeze: How Vendor Cloud Mandates Are Reshaping Enterprise Strategy

👍 Recommended For: CIOs grappling with vendor lock-in, IT directors evaluating hybrid cloud strategies, Enterprise architects seeking to mitigate SaaS risks

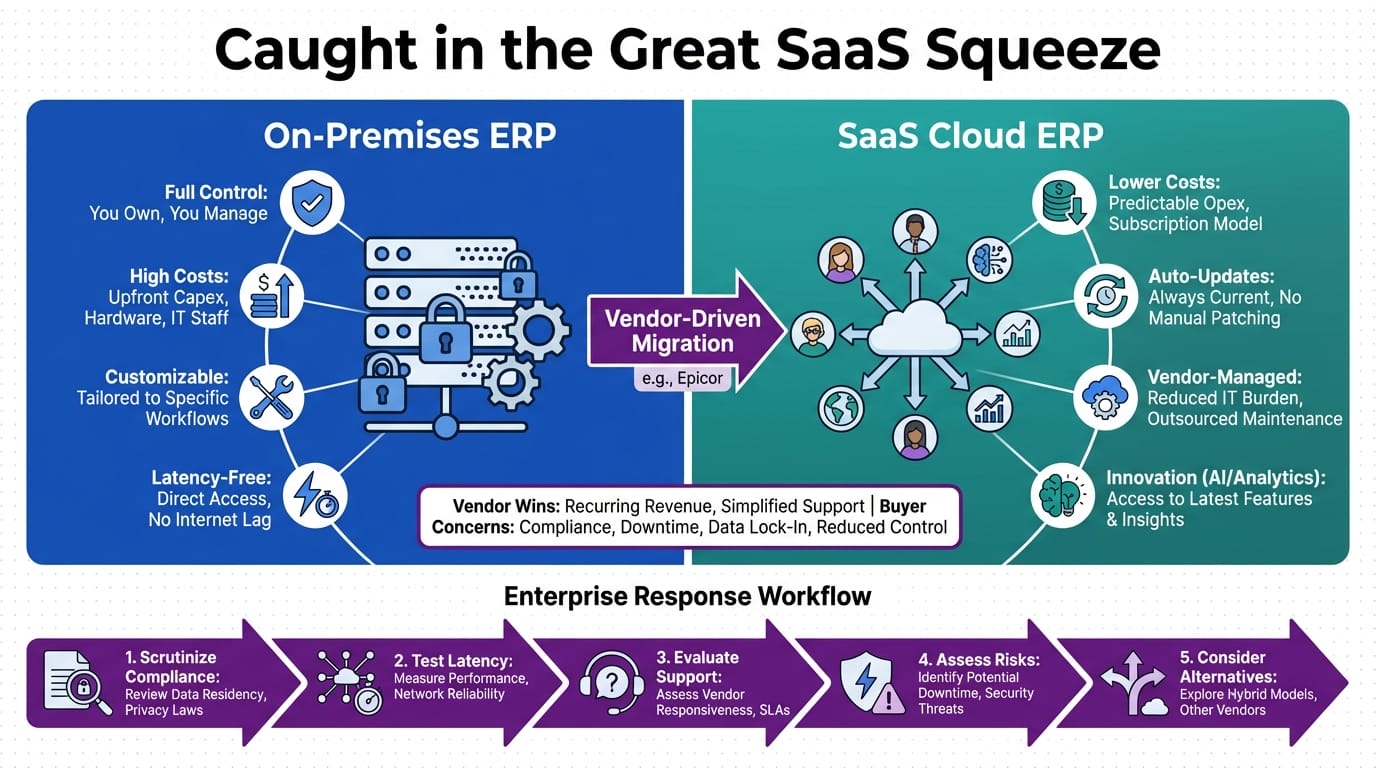

John: Alright, let’s cut through the noise. If you’re in enterprise IT, you’ve probably felt the pinch of what we’re calling the “Great SaaS Squeeze.” Major vendors are ditching on-premises options faster than a startup burns through VC cash, forcing businesses into cloud-only models. It’s not just a tech shift; it’s a fundamental change in how we think about risk, control, and long-term strategy. Drawing from recent insights in InfoWorld, this isn’t hype—it’s the new reality of enterprise software in 2026.

As a battle-hardened Senior Tech Lead, I’ve seen vendors pull this move before, but never at this scale. The squeeze comes from cloud mandates that eliminate on-prem choices, leaving enterprises to decide: adapt or get left behind. But here’s the engineering truth: while SaaS promises speed and scalability, it often trades away control for convenience. Recent industry reports, like those from StartUs Insights on SaaS trends, highlight how this convergence is amplifying risks in areas like data sovereignty and outage resilience.

Lila: For those new to this, think of it like renting an apartment versus owning a house. SaaS is the rental—quick to move in, but the landlord (vendor) calls the shots on renovations and evictions. On-prem is the house you own, with all the maintenance headaches but full control.

The “Before” State: Traditional On-Premises Dominance and Its Pain Points

Before this squeeze tightened, enterprises leaned heavily on on-premises software. You’d install ERP systems, databases, or CRM tools directly on your servers, giving you ironclad control over data, customizations, and security. It was like building a fortress: sturdy, but expensive to maintain. Upfront costs were massive—think millions for hardware, licenses, and IT staff. Scalability? Forget it; adding capacity meant weeks of procurement and setup.

The pain points were glaring. Vendor support for on-prem dwindled as they pivoted to cloud profits, leaving legacy systems vulnerable to exploits. Outages were on you—no auto-scaling magic. And compliance? A nightmare in regulated industries like finance or healthcare, where data locality rules demanded physical control. Now, with vendors like Oracle and SAP mandating SaaS transitions (as noted in recent CIO articles), that fortress is crumbling. The “before” state offered stability but at the cost of agility, locking businesses into outdated tech while competitors zipped ahead on cloud rails.

Contrast this with the emerging SaaS-dominated world: vendors are sunsetting on-prem options, pushing migrations that promise cost savings through subscription models and ROI via faster innovation. But it’s not all sunshine; the squeeze introduces new risks, like dependency on vendor uptime and potential data lock-in.

John: I’ve architected enough migrations to know the trade-offs. On-prem gave you sovereignty, but SaaS delivers velocity—if you navigate the pitfalls wisely.

Core Mechanism: Executive Insights into the SaaS Squeeze Dynamics

At its core, the Great SaaS Squeeze is driven by vendors’ economic incentives: recurring revenue from subscriptions beats one-time licenses. Structurally, this means rebuilding enterprise software around cloud-native architectures, often using microservices on platforms like AWS or Azure. From an executive lens, evaluate it through three pillars: strategy, risk, and control.

First, strategy: SaaS enables rapid deployment and integration with AI tools, as seen in the convergence trends from CIO reports. Vendors embed AI directly, offering predictive analytics without custom dev work. But the logic here is vendor-led innovation; your roadmap aligns with theirs, potentially sidelining unique business needs.

Second, risk: Outages in SaaS ecosystems, amplified by AI dependencies (per SC Media’s 2026 outlook), can cascade across supply chains. Mitigation involves hybrid models—keeping critical data on-prem while using SaaS for non-core functions. Structured reasoning: Assess vendor SLAs against your tolerance; if 99.99% uptime isn’t enough for healthcare ops, factor in redundancy costs.

Third, control: Data governance shifts to shared responsibility. Use frameworks like NIST for audits, ensuring compliance in multi-tenant environments. The business logic? Calculate total cost of ownership (TCO)—SaaS might slash capex but inflate opex if customizations require premium tiers.

[Important Insight] Recent research from MSP360 suggests automated security and identity-centric defenses are key to countering these risks, turning the squeeze into an opportunity for resilient architectures.

Use Cases: Real-World Applications of Navigating the Squeeze

Let’s ground this in reality with three scenarios.

1. Financial Services Firm Migrating ERP: A mid-sized bank faces SAP’s cloud mandate. Traditionally on-prem for compliance, they adopt a hybrid SaaS model, keeping sensitive data local while using cloud for analytics. Result? ROI boosts from AI-driven fraud detection, with risks mitigated via encrypted tunnels. Trade-off: Higher subscription costs, but offset by reduced hardware spend.

2. Healthcare Provider Optimizing Supply Chain: With vendors like Cerner pushing SaaS, a hospital chain integrates cloud-based inventory management. The squeeze forces a shift from legacy systems, enabling real-time tracking via IoT integrations. Practical value: During a 2026 supply shortage, AI predictions minimized disruptions, saving costs and improving patient care. Control is maintained through federated data models.

3. Manufacturing Enterprise Enhancing CRM: A global manufacturer squeezed by Salesforce’s on-prem sunset adopts SaaS for customer insights. Structured integration with on-prem MES systems creates a hybrid pipeline, leveraging AI for predictive sales. Scenario: Post-migration, lead conversion speed doubles, but they invest in vendor-agnostic APIs to avoid lock-in.

Lila: These aren’t pie-in-the-sky; they’re based on patterns from reports like the SaaS Industry Report 2026—real businesses turning mandates into advantages.

| Aspect | Old Method (On-Premises) | New Solution (SaaS/Hybrid) |

|---|---|---|

| Cost Structure | High upfront capex, ongoing maintenance | Subscription opex, scalable with usage |

| Scalability | Manual hardware additions, slow | Auto-scaling, instant elasticity |

| Risk & Control | Full control, but vendor support waning | Shared risk, enhanced with hybrids |

| Innovation Speed | Slow updates, custom dev required | Frequent AI-infused releases |

Conclusion: Key Insights and Next Steps

The Great SaaS Squeeze isn’t a crisis—it’s a catalyst for smarter enterprise architecture. By understanding the shift from on-prem fortresses to cloud agility, leaders can harness benefits like speed, cost efficiency, and ROI while mitigating risks through hybrids and robust governance. Industry analysts expect this trend to accelerate, with SaaS markets hitting $702 billion by 2030 per Allied Market Research.

Next steps? Audit your vendor contracts for sunset clauses, pilot hybrid setups (e.g., using Azure Arc for on-prem/cloud bridging), and foster a mindset of vendor-agnostic design. Don’t get squeezed—squeeze back with informed strategy.

John: Remember, tech evolves, but smart engineering endures.

References & Further Reading

- Caught in the great SaaS squeeze | InfoWorld

- The convergence of SaaS and AI: Trends, opportunities and challenges | CIO

- SaaS Industry Report 2026 | StartUs Insights

- Top SaaS data challenges of 2026 | MSP360 Resources

▼ AI tools to streamline research and content production (free tiers may be available)

Free AI search & fact-checking

👉 Genspark

Recommended use: Quickly verify key claims and track down primary sources before publishing

Ultra-fast slides & pitch decks (free trial may be available)

👉 Gamma

Recommended use: Turn your article outline into a clean slide deck for sharing and repurposing

Auto-convert trending articles into short-form videos (free trial may be available)

👉 Revid.ai

Recommended use: Generate short-video scripts and visuals from your headline/section structure

Faceless explainer video generation (free creation may be available)

👉 Nolang

Recommended use: Create narrated explainer videos from bullet points or simple diagrams

Full task automation (start from a free plan)

👉 Make.com

Recommended use: Automate your workflow from publishing → social posting → logging → next-task creation

※Links may include affiliate tracking, and free tiers/features can change; please check each official site for the latest details.